Tax reclaims

The Tax Reclaims product is a product Kingfield was developing to provide a common platform and centralized location for all parties involved in a Tax Reclaim lifecycle to be able to file and process the recovery of foreign taxes withheld on dividend and interest payments. The goal was to deliver a sophisticated common case management system to increase the efficiency across all parties involved. The parties involved are the tax specialists, global custodians, asset managers, sub custodians, and third party tax vendors.

Overview

Outcome

The insights from the research and information provided helped our team make informed design decisions, to better equip users on how to collect reclaim events, correct documents, and move the reclaim through it’s lifecycle within a secure environment in a timely fashion.

Problem

The process to file a tax reclaim currently is a very time consuming and manual process. It involves large excel spreadsheets, manually documenting market tax rates, and majority of the time mailing, packaging, receiving physical documents, all while trying file everything in a timely manner.

Understanding the problem

Client Interview Insights

Some of our users leverage multiple applications to create and file a Tax Reclaim, which poses a few risks in the consistency of data across the applications

Document handling is a manual process, gathering, mailing and receiving physical documents to get a client’s wet signature, then manually validating and filing it into the system (dependent upon the market, document type, client)

There was a lack of communication amongst multiple specialists or teams who were working on a single tax reclaim, which caused delays in the tax reclaim process, hand offs were not communicated and the system was not smart enough to notify users that it was ready for the next step

TAX RECLAIM CREATION

The creation of an eligible reclaim includes a few factors, a minimum recovery amount, the market, the “events” (trade confirmations), and the sub-custodian. Currently these events are uploaded and sorted through via large excel spreadsheets. Our platform today is to help the tax specialist detect eligible reclaims to create, and for the future-state, be able to kick-start the reclaim process when events have been determined eligible for a reclaim.

We started off by putting together a user journeys in adding events to a reclaim.

There was collaboration amongst the UX, VD and product team to decide upon the first pass of the designs.

Document Management & document presets

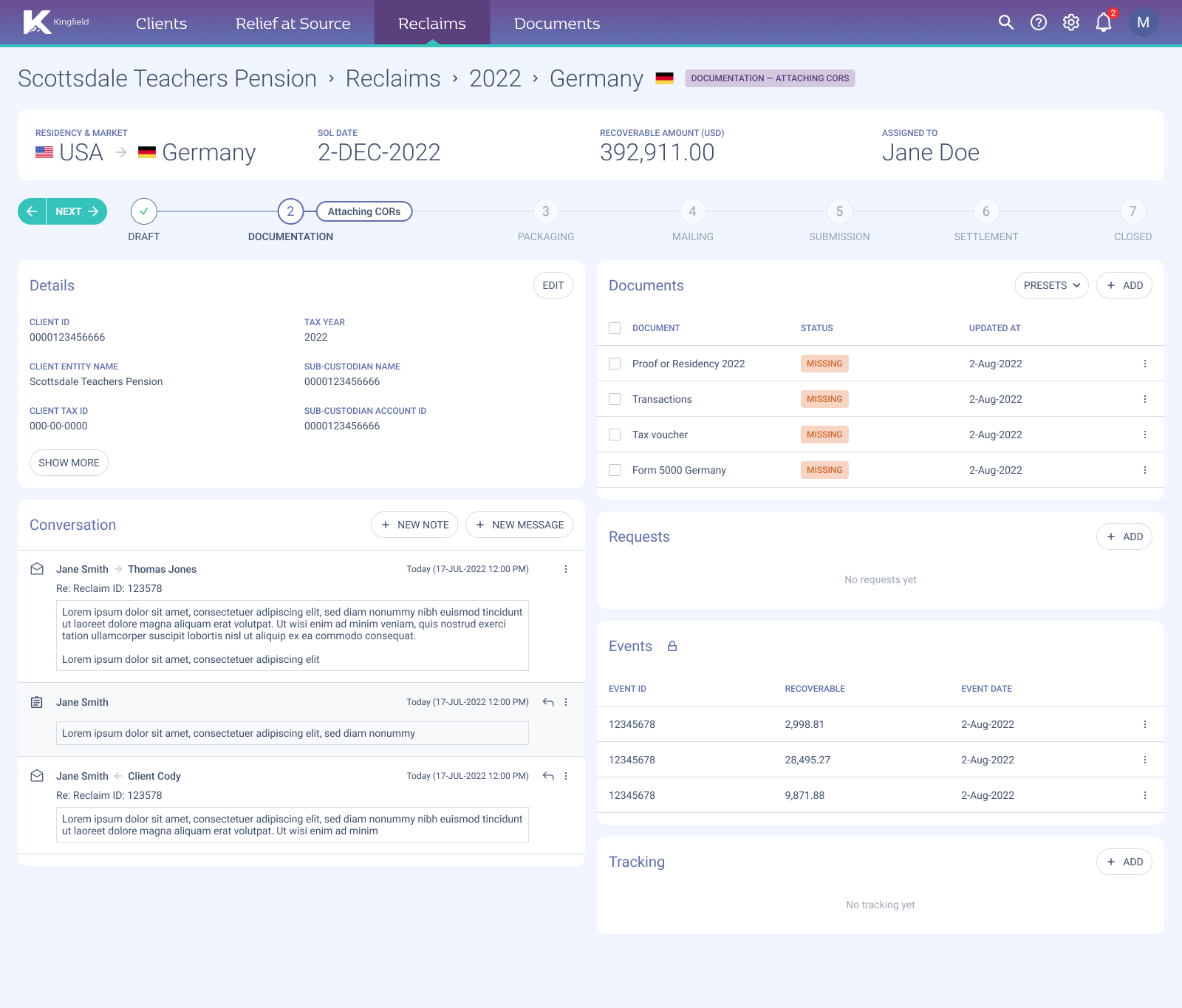

With today’s manual process of mailing and receiving physical documents, not accounting for possible human error, this step in the process can delay the tax reclaim filing and can become repetitive. There are a few variables when selecting the right documents to add to an existing reclaim: market, tax year, sub-custodian, relief at source, just to name a few. We are solving this issue by providing Tax Specialists the ability to manage a list of documents within a Tax Reclaim Case electronically to mitigate any possible delays and human errors. The user would have the ability to either create a list of documents from scratch and save the list of documents they’ve compiled as a future preset (list) to add to any similar Tax Reclaim Case, or browse through existing document presets to preload into the reclaim they are working on, duplicate a preset, modify a preset and apply a saved preset to any similar Tax Reclaim Case.

Document Management

With the uploading and managing of documents, it made sense to provide users with a place to host their document templates as well as client documents.

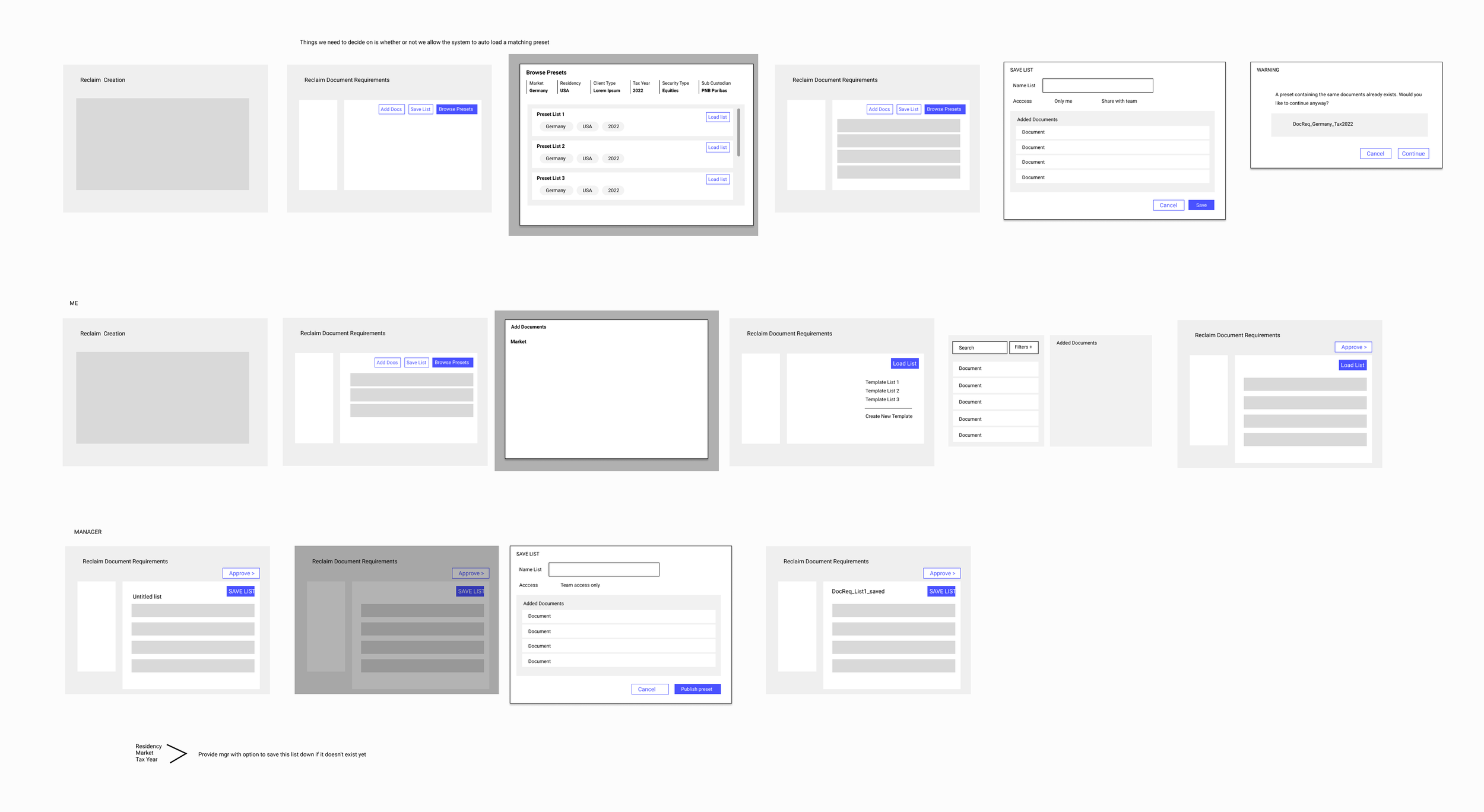

DOCUMENT PRESETS

User flows

Low-fidelity Concepts.

After going through a few iterations of wireframes and conducting user interviews to validate some of the assumptions made, I worked with the Visual Design team to ensure existing design patterns were being implemented.

DOCUMENT REQUIREMENTS

Activity Panel

Through our findings from user interviews, we discovered the need to provide users a centralized location to communicate the activity log of a reclaim, within their purview. This would equip the user to be able to view a timestamped log of parties involved, documents requested or uploaded, any communications between parties whether it be emails or internal notes sent within the platform.